Close demo

Close demo

Get high-level audience sizing, overlaps, and affinities instantly with Affinio Express queries. Then gauge whether to take segmentation further with a Affinio Classic detailed clustering report.

Uncover what the bulk of social users are all about. Many social users consume content but don’t actively post, yet Affinio surfaces valuable insights about full-picture audiences.

Slice audiences from more than 1B unbiased global profiles to proxy any persona for true scalability unmatched by surveys—drive global strategy without ever leaving your desk.

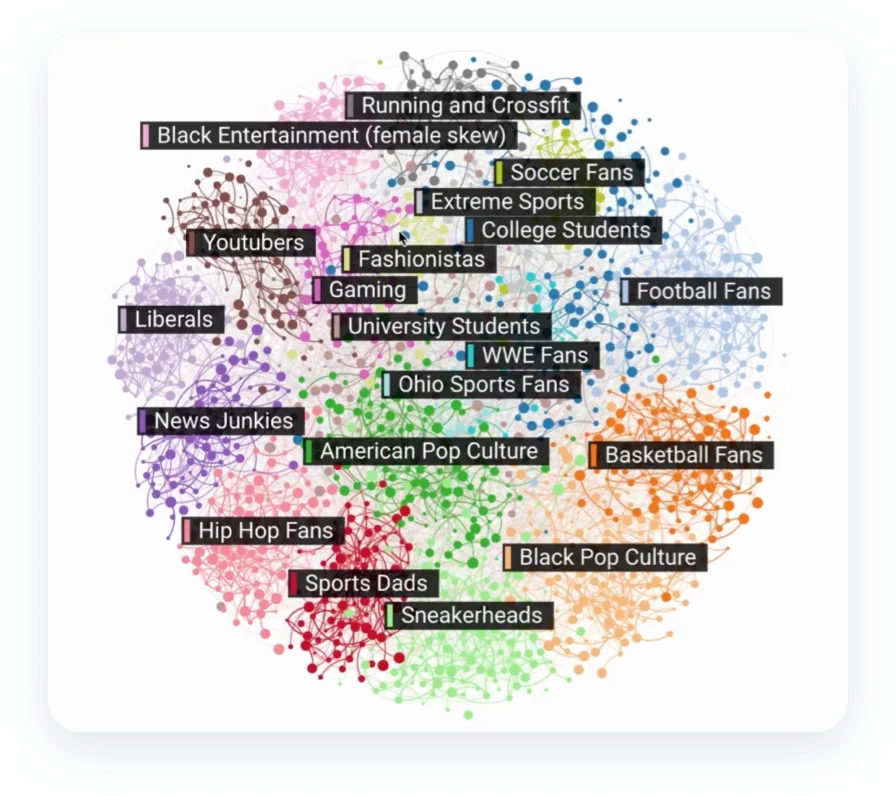

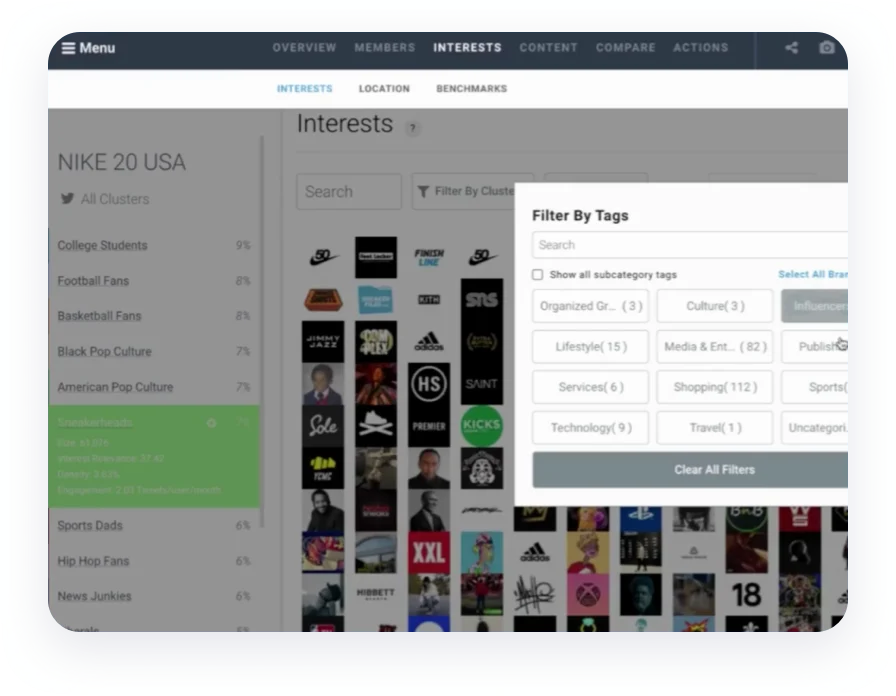

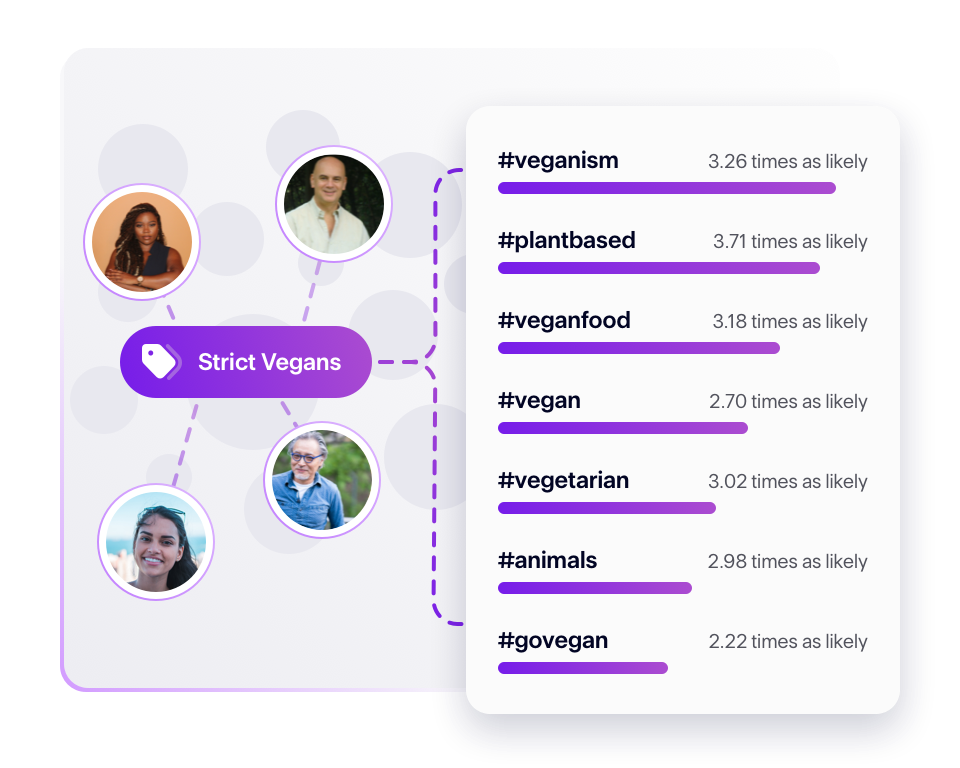

Leverage our Audience Intelligence platform to put yourself in the heart of any community, and quickly understand them through their interests, affinities, and the content they consume. Whether you’re trying to win new client pitches, or learn more about your existing or prospective audiences, Affinio has the answers for enabling personalization at scale.

Manage your PR crisis communications like never before - understand if the buzz online is just a blip, or something to be more concerned about. Now you can tackle any snafu with more facts than feelings at your disposal. Press can make or break a brand - and bad press happens fast, so stay on your toes with Affinio.

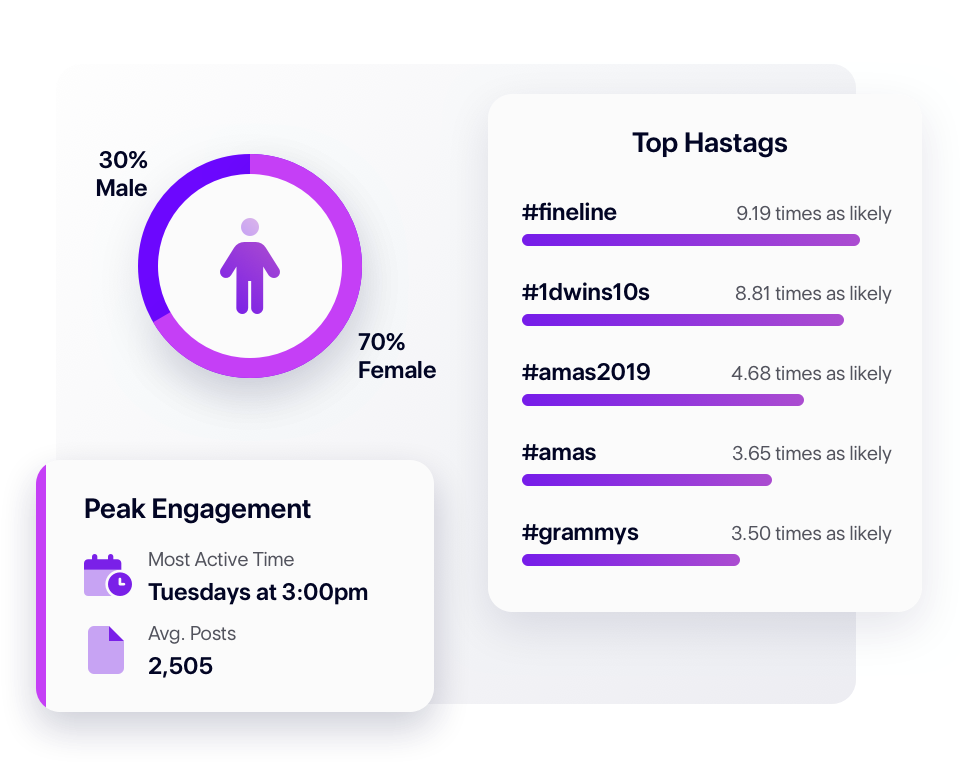

Whether you’re trying to better create personas, study competitors, choose media, or find relevant influencers - marketers can now have audience intelligence at their fingertips to plan and optimize campaigns, discovering hidden nuggets unknown before. Even benchmark your brand against competitors, general personas, media targets, or the rest of your owned portfolio.

Build brand partnerships that matter, and gain an upper hand in new business opportunities with Affinio. Power your efforts and be armed with everything you need to know to grow - from co-promotion opportunities, to micro and macro influencer selection, to ads sales prospecting, and even business acquisition targets.

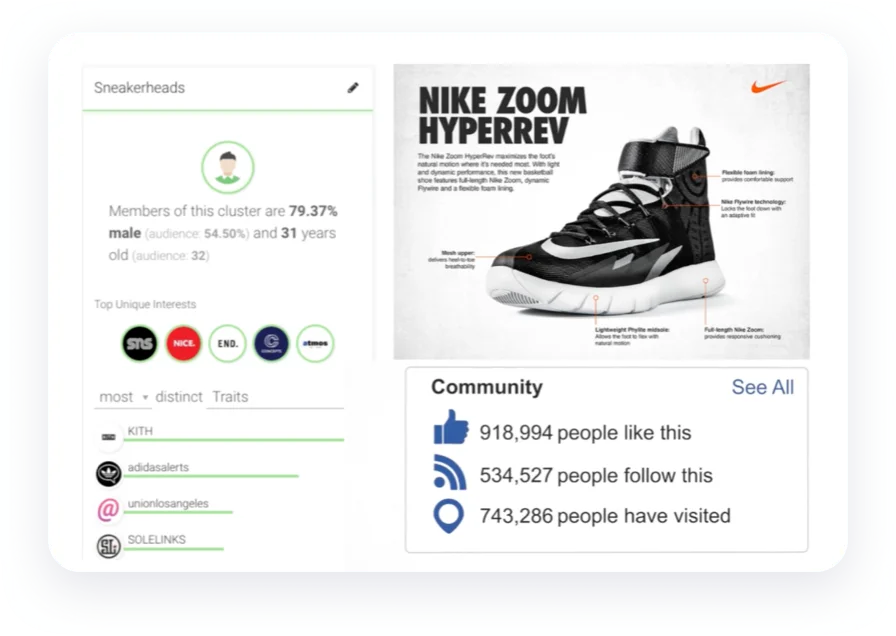

Run an analysis on any audience on Twitter - your customers, your client's, competitors, or a target audience. Affinio will collect this audience, segment it into clusters, and surface the insights in an easy-to-understand dashboard. Receive reports in 1-2 hours - which is a fraction of the time and cost of traditional research methods.

Gain insights on the silent majority who consume content and express their interests via following patterns — not posts. Flexibly define audiences through any lens: what people follow, how they self-describe, where they live, or what they talk about. With reporting like this, who needs to second guess their personas or targeting efforts?

With Affinio, you can collect everyone on Twitter sharing a specific URL to a website, article, etc. You can also upload a list of Twitter authors from social listening to personify a conversation. Affinio will segment this audience and surface their top interests and affinities. For crisis communications, PR and marketing campaigns - this reporting makes lemonade out of headaches.

Industry leaders use AFFINIO

Affinio gives me the opportunity to dive into the nuances of what makes individuals within clusters similar and what can make them different, who they follow and how I can better understand them. This informs what their behaviors might be and how I can utilize that within otherwise social listening and planning.

[Twitter] was the only platform where we could reach engaged users with Stephen King core content. We wanted people who talk about Stephen King, engage with him and so on, which Affinio Audiences does in spades.